A large part of Tryg's CO2e emissions come from the approximately 2.2 million annual claims. It requires large amounts of materials such as wood, metal, plastic and glass when our customers need to rebuild their house, repair a van or get a new mobile phone.

That's why we've, in close collaboration with our claims suppliers, have been working for years to break away from the ‘use-and-throw-away’ culture and instead push for a claims handling process where repair and reuse are more widespread. We work hard to minimise the size of a claim and ensure that more materials are preserved, repaired and reused. Without compromising on safety and quality, of course.

This new way of working requires a shift in mindset, which takes time and involves close collaboration, capacity building and knowledge sharing both internally across relevant teams, such as procurement, claims and the insurance assessors, as well as externally towards and between suppliers and partners.

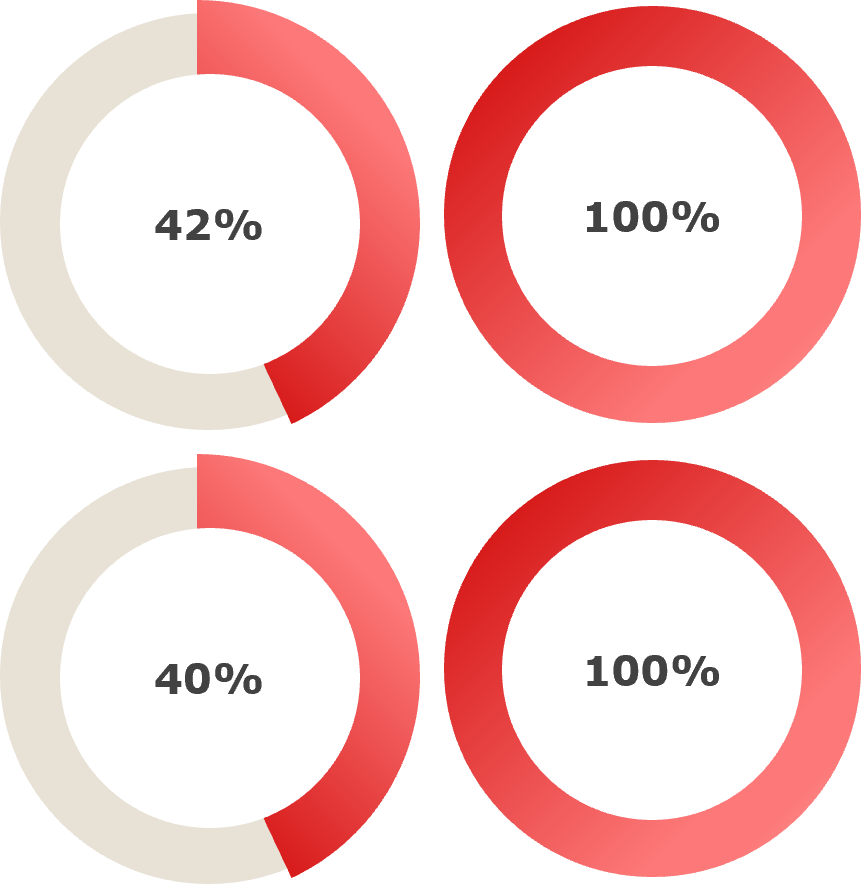

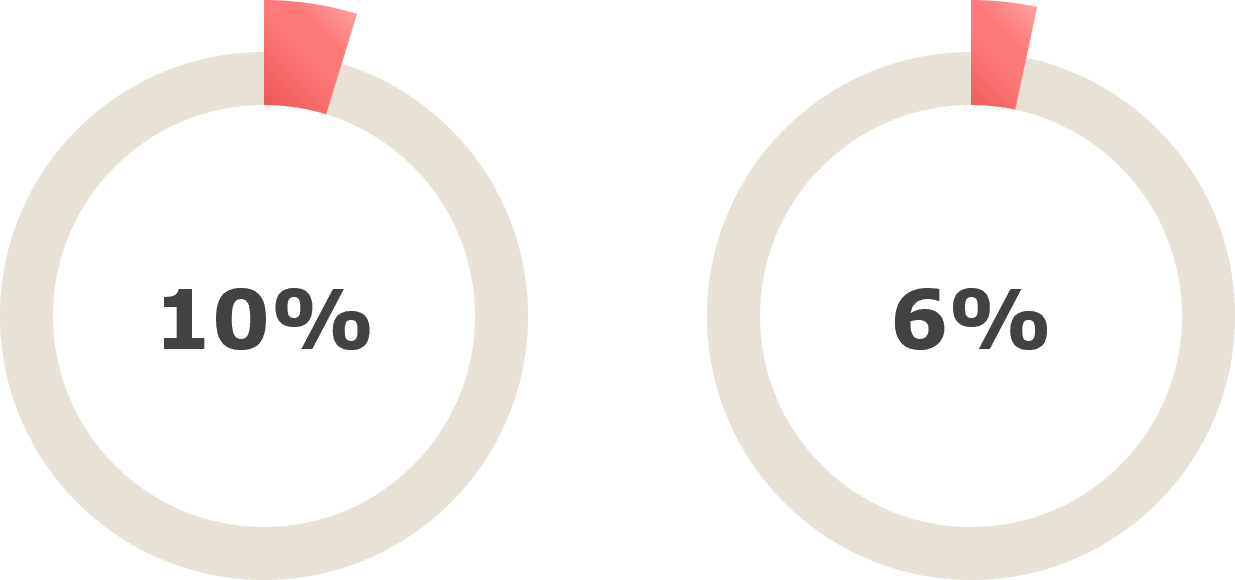

Two targets for 2027 guide our efforts around material use in the claims handling process:

- Reduce the consumption of new materials by 10% across all types of claims

- Reduce CO2e emissions by 6% per average claim.